Business Insights : Equatorial Guinea

Registration as a Customs Broker in Equatorial Guinea

Temporary Registration

The Generale Directorate of Custom stated that in Equatorial Guinea custom agents are required to obtain a temporary registration before they can apply for a permanent registration at the level of CEMAC. The temporary registration allows applicants to provide customs agency related services in Equatorial Guinea only.

The application for temporary registration is submitted to the Directorate General of Customs and the validity of the registration is 1 year, renewable. The temporary registration fee is 1,000,000 XAF and, if all the documents listed below are provided, the application process may be completed within two (2) weeks from the date of submission.

The requirements for companies to obtain the temporary registration are:

- An application letter on stamped paper with a value of 1,000 XAF addressed to the Director General of Customs;

- Registration Certificate and Tax Identification Number, if registered at the Single Desk Office (Ventanilla Unica Empresarial);

- Notary’s Certificate;

- The Articles of Association of the Applicant;

- The Criminal Record Certificate of the Manager/Managing Director/CEO of the company;

- A Tax solvency certificate for the company;

- A photocopy of the identity card or passport of the Manager/Managing Director/CEO and chief declarant;

- A copy of the CVs of the Manager/Managing Director/CEO and chief declarant; Academic Diploma of the Chief Declarant indicating the customs related education; and

- A chief declarant with at least five (5) years of experience.

Applications are assessed and approved by the Director General of Customs who recommends if the Ministry of Finance should issue a temporary registration to the applicant. Companies are required to renew their temporary registration annually and maintain it for a period of at least three (3) years before they can apply for the permanent registration at the CEMAC level.

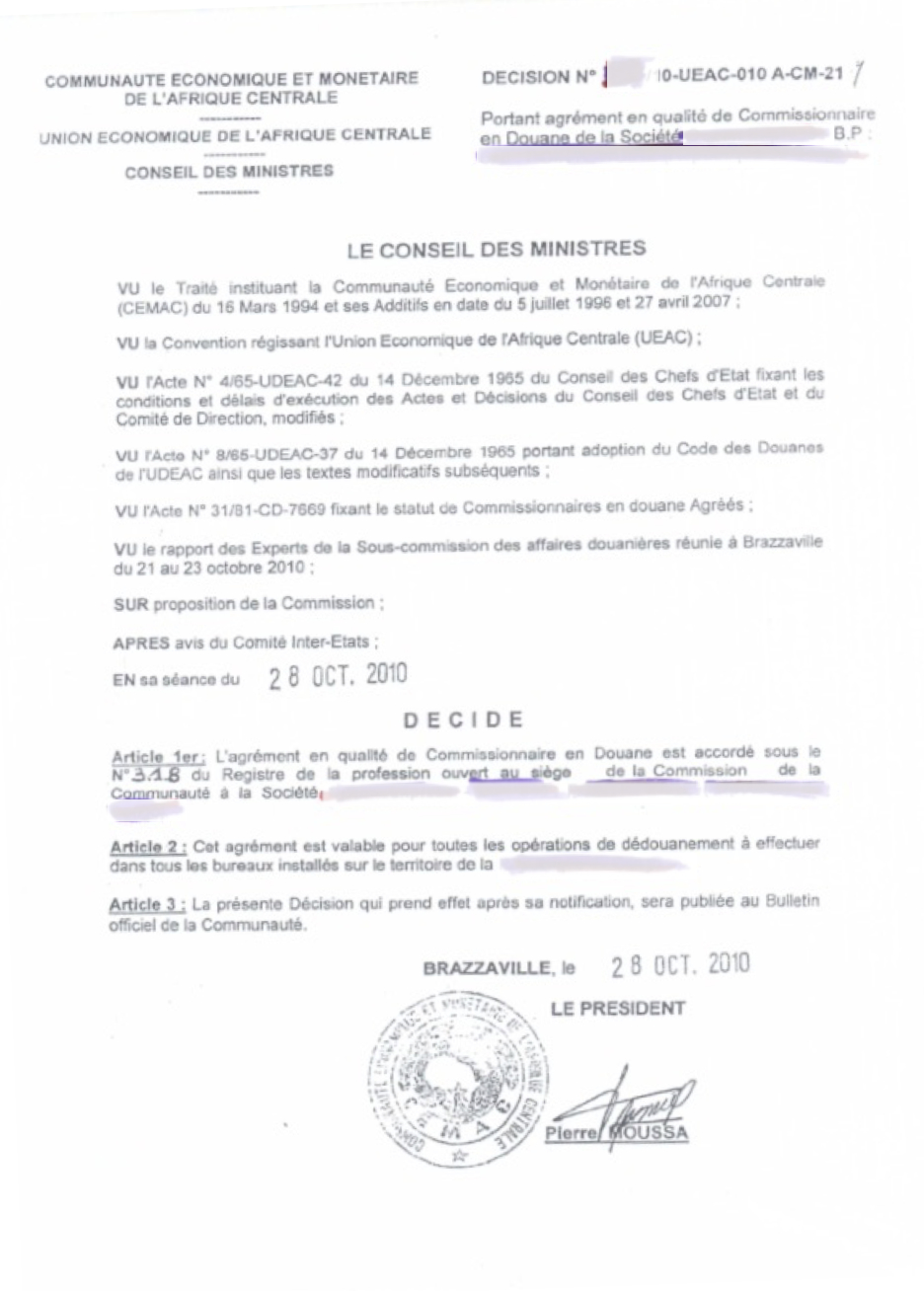

In other CEMAC member states, only the submission of applications at the level of CEMAC via the respective Directorate Generale of Customs in each member state is contemplated. Following which, the application is submitted to the sub-committee on customs affairs and based on the proposal of the CEMAC Commission and the opinion of the inter-state committee, the Council of Ministers of UEAC issues a decision. Having said that, the General Directorate of Customs of the Ministry of Finance in Equatorial Guinea confirmed that member states have been granted discretionary powers to require applicants to first register temporarily.

Permanent Registration

The Regulation provides that those wishing to become customs agent across all CEMAC member states must apply by registered mail to the Chairman of the Advisory Committee of Authorised Customs Agents of the State where they wish to exercise the profession.

In practice, applications are submitted via the Directorate General of Customs which acts as the Chairman of the Advisory Committee of Authorised Customs Agents in Equatorial Guinea.

The formalities provided below must be met and following a preliminary assessment by the Director General of Customs the file is transferred to CEMAC for the issuance of the decision authorising the applicant to act as a custom agent in all CEMAC member states.

The application, in duplicate and on stamp paper, must indicate the customs office or offices where the profession of customs agent would be exercised, mention all useful information on the expected traffic.

The fees associated with the permanent registration are advised during the completion of the formalities and the application process can take between 3-6 months or longer, depending on the meeting of the members of the Council of Ministers.

Applications are submitted to the sub-committee on customs affairs and based on the proposal of the CEMAC Commission and the opinion of the inter-state committee, the Council of Ministers of UEAC issues a decision.

Formalities For Companies:

- Articles of Association of the Company;

- Extract from the State Gazette (Boletin Oficial del Estado);

- Trade register number;

- Bank guarantee; and

- A declaration by the company attesting to its commitment to cause its registration with a national corporate group within 3 months of the effective date of the approval.

Additional Requirements For a Public Limited Company:

- A copy of the resolution appointing the Executives of the Company;

- For companies managed by a board of directors, the CEO or CEOs who may be deputies or chairman and possibly the provisional administrator delegated to exercise the functions of chairman;

- For companies managed by a management board, the chairman of the management board or the sole managing director and possibly the managing director(s) authorised by the supervisory board, when the statutes so authorise, to represent the company;

- Birth certificate or any other document in lieu thereof of the executives or managers of the Company; and

- An extract from the criminal record or any other document in lieu thereof of the executives or managers of the Company.

Additional Requirements for Limited Liability Companies:

- A copy of the deliberation during which the manager(s) were appointed if they are not statutory;

- Birth certificate or any other document in lieu thereof of the manager(s);

- An extract from the criminal record or any other document in lieu thereof of the manager(s);

- A declaration by the manager(s) that the company has an establishment in which the documents referred to in Article 118 of the Customs Code will be kept; and

- The companies shall also apply to obtain the approval of the persons authorised to represent them, supported by:

- An extract from the judicial record concerning these persons or any other document in lieu thereof;

- A birth certificate concerning these persons or any other document in lieu thereof;

- A certificate attesting that the person responsible for customs operations and entitled to represent the company has exercised, for a period of five years, in a public or private sector an activity in the field of transit, clearance of goods or international trade; or a certificate duly signed by the National Director of Customs of the country concerned, certifying the required seniority for former customs officials;

- A certified copy of a bachelor’s degree or equivalent higher education diploma recognised by the State in the same field; or a certificate duly signed by the National Director of Customs of the country concerned, certifying the required seniority for former customs officers.

Formalities For Natural Persons :

- Birth certificate or any other document in lieu thereof;

- An extract from the criminal record or any other document in lieu thereof;

- A certificate attesting that the applicant has exercised, for a period of at least five years, in a public or private sector, an activity in the field of transit, clearance of goods or international trade; or a certificate duly signed by the National Director of Customs of the country concerned, certifying the required seniority for former customs officers;

- A certified copy of the bachelor’s degree or an equivalent state-recognised higher education diploma in the same field; or a certificate duly signed by the National Director of Customs of the country concerned, certifying the required seniority for former customs officers;

- An attestation of deposit of a bank guarantee;

- A certificate of registration in the trade register and the register of patents in the State where the activity is to be carried out;

- A declaration attesting that the applicant has in the concerned locality the establishment referred to in above;

- A declaration attesting that the applicant undertakes to cause his registration to a national corporate group within 3 months from the effective date of the approval;

- A declaration by the CEO or the Management Board indicating the names, places and dates of birth and nationalities of the members of the Board of Directors or Management Board and the Supervisory Board; and

- A declaration by the persons referred to in the first two paragraphs stating that the company has an establishment in which the documents referred to in Article 118 of the Customs Code will be kept.

Abraham Abia Biteo Roka is the Managing Director at Clarence and widely recognised as one of the leading energy lawyers in Equatorial Guinea, often speaking at events around the world. Abraham is particularly renowned for his ability to create and implement country and sector specific standards, policies and procedures.

ABOUT CLARENCE

Clarence offers its clients the freedom to operate in Africa. Thanks to our diverse resources, we understand Africa better than most firms. We assist clients to identify, assess and effectively minimise operational legal and regulatory risks. We develop creative and efficient solutions to operational challenges, so our clients can focus on growth and revenue. Our approach is to bridge the gap between external and in-house counsels. Our areas of practice include Energy and Natural Resources, Real Estate, Construction, Joint Ventures, Corporate and Commercial, Risk Management & Compliance, Litigation and Dispute Resolution, Government Relations, Customs and Taxation, Employment and Immigration, Aviation and Telecommunications. For enquiries, please contact us at info@clarenceabogados.com